Friday, February 10, 2012

Emancipation Proclamation

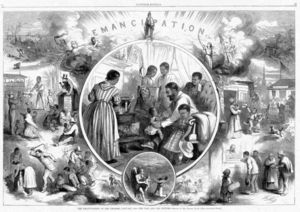

The Emancipation Proclamation is an executive order issued by United States President Abraham Lincoln during the American Civil War under his war powers. It proclaimed the freedom of 3.1 million of the nation's 4 million slaves, and immediately freed 50,000 of them, with the rest freed as Union armies advanced.[1] On September 22, 1862, Lincoln announced that he would issue a formal emancipation of all slaves in any state of the Confederate States of America that did not return to Union control by January 1, 1863. The actual order was signed and issued January 1, 1863; it named the locations under Confederate control where it would apply. Lincoln issued the Executive Order by his authority as "Commander in Chief of the Army and Navy" under Article II, section 2 of the United States Constitution.[2]

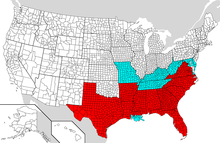

Coverage

The proclamation did not cover the 800,000 slaves in the slave-holding border states of Missouri, Kentucky, West Virginia, Maryland or Delaware, which were Union states; slaves there were freed by separate state and federal actions. The state of Tennessee had already mostly returned to Union control, so it also was not named and was exempted. Virginia was named, but exemptions were specified for the 48 counties that were in the process of forming West Virginia, as well as seven other named counties and two cities. Also specifically exempted were New Orleans and 13 named parishes of Louisiana, all of which were also already mostly under Federal control at the time of the Proclamation.

The Emancipation Proclamation was ridiculed for freeing only the slaves over which the Union had no power. Over 50,000 were freed the day it went into effect[3] in parts of nine of the ten states to which it applied (Texas being the exception).[4] In every Confederate state (except Tennessee and Texas), the Proclamation went into immediate effect in Union-occupied areas and at least 20,000 slaves[3][4] were freed at once on January 1, 1863.

Additionally, the Proclamation provided the legal framework for the emancipation of nearly all four million slaves as the Union armies advanced, and committed the Union to ending slavery, which was a controversial decision even in the North. Hearing of the Proclamation, more slaves quickly escaped to Union lines as the Army units moved South. As the Union armies advanced through the Confederacy, thousands of slaves were freed each day until nearly all (approximately 4 million, according to the 1860 census)[5] were freed by July 1865.

Near the end of the war, abolitionists were concerned that while the Proclamation had freed most slaves as a war measure, it had not made slavery illegal. Several former slave states had already passed legislation prohibiting slavery; however, in a few states, slavery continued to be legal, and to exist, until December 18, 1865, when the Thirteenth Amendment was enacted.

Background

The Fugitive Slave Law of 1850 required individuals to return runaway slaves to their owners. During the war, Union generals such as Benjamin Butler, declared that slaves in occupied areas were contraband of war and accordingly refused to return them. This decision was controversial because it implied recognition of the Confederacy as a separate nation under international law, a notion that Lincoln steadfastly denied. As a result, he did not promote the contraband designation. Some generals also declared the slaves under their jurisdiction to be free and were replaced when they refused to rescind such declarations.

On March 13, 1862, Lincoln forbade Union Army officers from returning fugitive slaves. On April 10, 1862, Congress declared that the federal government would compensate slave owners who freed their slaves. Slaves in the District of Columbia were freed on April 16, 1862 and their owners were compensated. On June 19, 1862, Congress prohibited slavery in United States territories. By this act, they opposed the 1857 opinion of the Supreme Court of the United States in the Dred Scott Case that Congress was powerless to regulate slavery in U.S. territories.

In January 1862, Thaddeus Stevens, the Republican leader in the House, called for total war against the rebellion to include emancipation of slaves, arguing that emancipation, by forcing the loss of enslaved labor, would ruin the rebel economy. In July 1862, Congress passed and Lincoln signed the "Second Confiscation Act." It liberated slaves held by "rebels".[6] It provided:

SEC. 2. And be it further enacted, That if any person shall hereafter incite, set on foot, assist, or engage in any rebellion or insurrection against the authority of the United States, or the laws thereof, or shall give aid or comfort thereto, or shall engage in, or give aid and comfort to, any such existing rebellion or insurrection, and be convicted thereof, such person shall be punished by imprisonment for a period not exceeding ten years, or by a fine not exceeding ten thousand dollars, and by the liberation of all his slaves, if any he have; or by both of said punishments, at the discretion of the court.SEC. 9. And be it further enacted, That all slaves of persons who shall hereafter be engaged in rebellion against the government of the United States, or who shall in any way give aid or comfort thereto, escaping from such persons and taking refuge within the lines of the army; and all slaves captured from such persons or deserted by them and coming under the control of the government of the United States; and all slaves of such person found or being within any place occupied by rebel forces and afterwards occupied by the forces of the United States, shall be deemed captives of war, and shall be forever free of their servitude, and not again held as slaves.

Abolitionists had long been urging Lincoln to free all slaves. A mass rally in Chicago on September 7, 1862, demanded an immediate and universal emancipation of slaves. A delegation headed by William W. Patton met the President at the White House on September 13. Lincoln had declared in peacetime that he had no constitutional authority to free the slaves. Even used as a war power, emancipation was a risky political act. Public opinion as a whole was against it.[7] There would be strong opposition among Copperhead Democrats and an uncertain reaction from loyal border states. Delaware and Maryland already had a high percentage of free blacks: 91.2% and 49.7%, respectively, in 1860.[8]

Lincoln first discussed the proclamation with his cabinet in July 1862. He believed he needed a Union victory on the battlefield so his decision would appear positive and strong. The Battle of Antietam, in which Union troops turned back a Confederate invasion of Maryland, gave him the opportunity to issue a preliminary proclamation on September 22, 1862. Lincoln had first shown an early draft of the proclamation to his Vice president Hannibal Hamlin,[9] an ardent abolitionist, who was more often kept in the dark on presidential decisions. The final proclamation was issued January 1, 1863. Although implicitly granted authority by Congress, Lincoln used his powers as Commander-in-Chief of the Army and Navy, "as a necessary war measure" as the basis of the proclamation, rather than the equivalent of a statute enacted by Congress or a constitutional amendment.

Initially, the Emancipation Proclamation effectively freed only a small percentage of the slaves, those who were behind Union lines in areas not exempted. Most slaves were still behind Confederate lines or in exempted Union-occupied areas. Secretary of State William H. Seward commented, "We show our sympathy with slavery by emancipating slaves where we cannot reach them and holding them in bondage where we can set them free." Had any slave state ended its secession attempt before January 1, 1863, it could have kept slavery, at least temporarily. The Proclamation only gave Lincoln the legal basis to free the slaves in the areas of the South that were still in rebellion. However, it also took effect as the Union armies advanced into the Confederacy.

The Emancipation Proclamation also allowed for the enrollment of freed slaves into the United States military. During the war nearly 200,000 blacks, most of them ex-slaves, joined the Union Army. Their contributions gave the North additional manpower that was significant in winning the war. The Confederacy did not allow slaves in their army as soldiers until the final months before its defeat.

Though the counties of Virginia that were soon to form West Virginia were specifically exempted from the Proclamation (Jefferson County being the only exception), a condition of the state's admittance to the Union was that its constitution provide for the gradual abolition of slavery. Slaves in the border states of Maryland and Missouri were also emancipated by separate state action before the Civil War ended. In Maryland, a new state constitution abolishing slavery in the state went into effect on November 1, 1864. In early 1865, Tennessee adopted an amendment to its constitution prohibiting slavery.[10][11] Slaves in Kentucky and Delaware were not emancipated until the Thirteenth Amendment was ratified.

Implementation

The Proclamation was issued in two parts. The first part, issued on September 22, 1862, was a preliminary announcement outlining the intent of the second part, which officially went into effect 100 days later on January 1, 1863, during the second year of the Civil War. It was Abraham Lincoln's declaration that all slaves would be permanently freed in all areas of the Confederacy that had not already returned to federal control by January 1863. The ten affected states were individually named in the second part (South Carolina, Mississippi, Florida, Alabama, Georgia, Louisiana, Texas, Virginia, Arkansas, North Carolina). Not included were the Union slave states of Maryland, Delaware, Missouri and Kentucky. Also not named was the state of Tennessee, which was at the time more or less evenly split between Union and Confederacy. Specific exemptions were stated for areas also under Union control on January 1, 1863, namely 48 counties that would soon become West Virginia, seven other named counties of Virginia including Berkeley and Hampshire counties which were soon added to West Virginia, New Orleans and 13 named parishes nearby.

Union-occupied areas of the Confederate states where the proclamation was put into immediate effect by local commanders included Winchester, Virginia,[12] Corinth, Mississippi,[13] the Sea Islands along the coasts of the Carolinas and Georgia,[14] Key West, Florida,[15] and Port Royal, South Carolina.[16]

Immediate impact

It is common to encounter a claim that the Emancipation Proclamation did not immediately free a single slave. As a result of the Proclamation, many slaves were freed during the course of the war, beginning with the day it took effect. Eyewitness accounts at places such as Hilton Head, South Carolina,[17] and Port Royal, South Carolina,[16] record celebrations on January 1 as thousands of blacks were informed of their new legal status of freedom.

Estimates of the number of slaves freed immediately by the Emancipation Proclamation are uncertain. One contemporary estimate put the 'contraband' population of Union-occupied North Carolina at 10,000, and the Sea Islands of South Carolina also had a substantial population. Those 20,000 slaves were freed immediately by the Emancipation Proclamation."[3] This Union-occupied zone where freedom began at once included parts of eastern North Carolina, the Mississippi Valley, northern Alabama, the Shenandoah Valley of Virginia, a large part of Arkansas, and the Sea Islands of Georgia and South Carolina.[18] Although some counties of Union-occupied Virginia were exempted from the Proclamation, the lower Shenandoah Valley, and the area around Alexandria were covered.[3]

Booker T. Washington, as a boy of 9 in Virginia, remembered the day in early 1865:[19]

As the great day drew nearer, there was more singing in the slave quarters than usual. It was bolder, had more ring, and lasted later into the night. Most of the verses of the plantation songs had some reference to freedom.... Some man who seemed to be a stranger (a United States officer, I presume) made a little speech and then read a rather long paper—the Emancipation Proclamation, I think. After the reading we were told that we were all free, and could go when and where we pleased. My mother, who was standing by my side, leaned over and kissed her children, while tears of joy ran down her cheeks. She explained to us what it all meant, that this was the day for which she had been so long praying, but fearing that she would never live to see.

The Emancipation took place without violence by masters or ex-slaves. The proclamation represented a shift in the war objectives of the North—reuniting the nation was no longer the only goal. It represented a major step toward the ultimate abolition of slavery in the United States and a "new birth of freedom".

Runaway slaves who had escaped to Union lines had previously been held by the Union Army as "contraband of war" under the Confiscation Acts; when the proclamation took effect, they were told at midnight that they were free to leave. The Sea Islands off the coast of Georgia had been occupied by the Union Navy earlier in the war. The whites had fled to the mainland while the blacks stayed. An early program of Reconstruction was set up for the former slaves, including schools and training. Naval officers read the proclamation and told them they were free.

In the military, reaction to the proclamation varied widely, with some units nearly ready to mutiny in protest. Some desertions were attributed to it. Other units were inspired by the adoption of a cause that ennobled their efforts, such that at least one unit took up the motto "For Union and Liberty".

Slaves had been part of the "engine of war" for the Confederacy. They produced and prepared food; sewed uniforms; repaired railways; worked on farms and in factories, shipping yards, and mines; built fortifications; and served as hospital workers and common laborers. News of the Proclamation spread rapidly by word of mouth, arousing hopes of freedom, creating general confusion, and encouraging thousands to escape to Union lines.

Political impact

The Proclamation was immediately denounced by Copperhead Democrats who opposed the war and advocated restoring the union by allowing slavery. Horatio Seymour, while running for the governorship of New York, cast the Emancipation Proclamation as a call for slaves to commit extreme acts of violence on all white southerners, he said it was "a proposal for the butchery of women and children, for scenes of lust and rapine, and of arson and murder, which would invoke the interference of civilized Europe."[22] The Copperheads also saw the Proclamation as an unconstitutional abuse of Presidential power, editor Henry A. Reeves wrote in Greenport's Republican Watchman that "In the name of freedom of Negroes, [the proclamation] imperils the liberty of white men; to test a utopian theory of equality of races which Nature, History and Experience alike condemn as monstrous, it overturns the Constitution and Civil Laws and sets up Military Usurpation in their Stead."[22]

Racism remained pervasive on both sides of the conflict and many in the North only supported the war as an effort to force the south back into the Union. The promises of many Republican politicians that the war was to restore the Union and not about black rights or ending slavery were now declared lies by their opponents citing the Proclamation. Copperhead David Allen spoke to a rally in Columbiana, Ohio, stating "I have told you that this war is carried on for the Negro. There is the proclamation of the President of the United States. Now fellow Democrats I ask you if you are going to be forced into a war against your Brethren of the Southern States for the Negro. I answer No!"[22] The Copperheads saw the Proclamation as irrefutable proof of their position and the beginning of a political rise for their members; in Connecticut H.B. Whiting wrote that the truth was now plain even to "those stupid thick-headed persons who persisted in thinking that the President was a conservative man and that the war was for the restoration of the Union under the Constitution."[22]

War Democrats who rejected the Copperhead position within their party, found themselves in a quandary. While throughout the war they had continued to espouse the racist positions of their party and their disdain of the concerns of slaves, they did see the Proclamation as a viable military tool against the South and worried that opposing it might demoralize troops in the Union army. The question would continue to trouble them and eventually lead to a split within their party as the war progressed.[22]

Lincoln further alienated many in the Union two days after issuing the preliminary copy of the Emancipation Proclamation by suspending habeas corpus. His opponents linked these two actions in their claims that he was becoming a despot. In light of this and a lack of military success for the Union armies, many War Democrat voters who had previously supported Lincoln turned against him and joined the Copperheads in the off-year elections held in October and November.[22]

In the 1862 elections, the Democrats gained 28 seats in the House as well as the governorship of New York. Lincoln's friend Orville Hickman Browning told the President that the Proclamation and the suspension of habeas corpus had been "disastrous" for his party by handing the Democrats so many weapons. Lincoln made no response. Copperhead William Javis of Connecticut pronounced the election the "beginning of the end of the utter downfall of Abolitionism."[22]

Historians James M. McPherson and Allan Nevins state that though the results look very troubling, they could be seen favorably by Lincoln; his opponents did well only in their historic strongholds and "at the national level their gains in the House were the smallest of any minority party's in an off-year election in nearly a generation. Michigan, California, and Iowa all went Republican...Moreover, the Republicans picked up five seats in the Senate."[22] McPherson states "If the election was in any sense a referendum on emancipation and on Lincoln's conduct of the war, a majority of Northern voters endorsed these policies."[22]

International impact

As Lincoln had hoped, the Proclamation turned foreign popular opinion in favor of the Union by adding the ending of slavery as a goal of the war. That shift ended the Confederacy's hopes of gaining official recognition, particularly from the United Kingdom, which had abolished slavery. Prior to Lincoln's decree, Britain's actions had favored the Confederacy, especially in its provision of British-built warships such as the CSS Alabama and CSS Florida. Furthermore, the North's determination to win at all costs was creating problems diplomatically; the Trent Affair of late 1861 had caused severe tensions between the United States and Great Britain. For the Confederacy to receive official recognition by foreign powers would have been a further blow to the Union cause.

With the war now cast in terms of freedom against slavery, British or French support for the Confederacy would look like support for slavery, which both of these nations had abolished. As Henry Adams noted, "The Emancipation Proclamation has done more for us than all our former victories and all our diplomacy." In Italy, Giuseppe Garibaldi hailed Lincoln as "the heir of the aspirations of John Brown". On August 6, 1863 Garibaldi wrote to Lincoln: Posterity will call you the great emancipator, a more enviable title than any crown could be, and greater than any merely mundane treasure.[23]

Alan Van Dyke, a representative for workers from Manchester, England, wrote to Lincoln saying, "We joyfully honor you for many decisive steps toward practically exemplifying your belief in the words of your great founders: 'All men are created free and equal.'" The Emancipation Proclamation served to ease tensions with Europe over the North's conduct of the war, and combined with the recent failed Southern offensive at Antietam to cut off any practical chance for the Confederacy to receive international support in the war.

Gettysburg Address

Lincoln's Gettysburg Address in November 1863 made indirect reference to the Proclamation and the ending of slavery as a war goal with the phrase "new birth of freedom". The Proclamation solidified Lincoln's support among the rapidly growing abolitionist element of the Republican Party and ensured they would not block his re-nomination in 1864.[24]

Postbellum

Near the end of the war, abolitionists were concerned that the Emancipation Proclamation would be construed solely as a war act and no longer apply once fighting ended. They were also increasingly anxious to secure the freedom of all slaves, not just those freed by the Emancipation Proclamation. Thus pressed, Lincoln staked a large part of his 1864 presidential campaign on a constitutional amendment to abolish slavery uniformly throughout the United States. Lincoln's campaign was bolstered by separate votes in both Maryland and Missouri to abolish slavery in those states. Maryland's new constitution abolishing slavery took effect in November 1864. Slavery in Missouri was ended by executive proclamation of its governor, Thomas C. Fletcher, on January 11, 1865.

Winning re-election, Lincoln pressed the lame duck 38th Congress to pass the proposed amendment immediately rather than wait for the incoming 39th Congress to convene. In January 1865, Congress sent to the state legislatures for ratification what became the Thirteenth Amendment, banning slavery in all U.S. states and territories. The amendment was ratified by the legislatures of enough states by December 6, 1865 and proclaimed 12 days later. There were about 40,000 slaves in Kentucky and 1,000 in Delaware who were liberated then.[5]

In the years after Lincoln's death, his action in the proclamation was lauded. The anniversary of the Emancipation Proclamation was celebrated as a black holiday for more than 50 years; the holiday of Juneteenth was created in some states to honor it.[25] In 1913, the 50th anniversary of the Proclamation, there were particularly large celebrations.

As the years went on and American life continued to be deeply unfair towards blacks, cynicism towards Lincoln and the Emancipation Proclamation increased.[citation needed]Some 20th century black intellectuals, including W. E. B. Du Bois, James Baldwin and Julius Lester, described the proclamation as essentially worthless. Perhaps the strongest attack was Lerone Bennett's Forced into Glory: Abraham Lincoln's White Dream (2000), which claimed that Lincoln was a white supremacist who issued the Emancipation Proclamation in lieu of the real racial reforms for which radical abolitionists pushed. In his Lincoln's Emancipation Proclamation, Allen C. Guelzo noted the professional historians' lack of substantial respect for the document, since it has been the subject of few major scholarly studies. He argued that Lincoln was America's "last Enlightenment politician"[26] and as such was dedicated to removing slavery strictly within the bounds of law.

Other historians have given more credit to Lincoln for what he accomplished within the tensions of his cabinet and a society at war, for his own growth in political and moral stature, and for the promise he held out to the slaves.[27] More might have been accomplished if he had not been assassinated. As Eric Foner wrote:

Lincoln was not an abolitionist or Radical Republican, a point Bennett reiterates innumerable times. He did not favor immediate abolition before the war, and held racist views typical of his time. But he was also a man of deep convictions when it came to slavery, and during the Civil War displayed a remarkable capacity for moral and political growth.[28]

This article is copied from an article on Wikipedia® - the free encyclopedia created and edited by online user community. The text was not checked or edited by anyone on our staff. Although the vast majority of the Wikipedia® encyclopedia articles provide accurate and timely information please do not assume the accuracy of any particular article. This article is distributed under the terms of GNU Free Documentation License.

Thanks to Encyclopedia The Free Dictionary / Farlex, Inc.

http://encyclopedia.thefreedictionary.com/p/Emancipation%20Proclamation

| To Get Uninterrupted Daily Article(s) / Review(s) Updates; Kindly Subscribe To This BlogSpot:- http://Ziaullahkhan.BlogSpot.com Via "RSS Feed" Or "Email Subscription". | |

| BlogSpot | |

| Other Sites Related To This Blog; Kindly Visit: | |

| Amazon Books | |

| Amazon Magazines | |

| Kindle Store | |

| Products | |

Do You Go By Your Head, Heart Or Gut?

http://profmsr.blogspot.in/2012/01/do-you-go-by-your-head-heart-or-gut.html

| To Get Uninterrupted Daily Article(s) / Review(s) Updates; Kindly Subscribe To This BlogSpot:- http://Ziaullahkhan.BlogSpot.com Via "RSS Feed" Or "Email Subscription" Or "Knowledge-Center Yahoo Group". | |

| BlogSpot | |

| Other Sites Related To This Blog; Kindly Visit: | |

| Amazon Books | |

| Amazon Magazines | |

| Kindle Store | |

| Products | |

| Google+ | |

| Facebook Page | |

Teach Your Team Smart(er) Decision Processes

Nothing happens without a decision. Nothing good happens without the right decision. And, in case you doubt the need to focus on making better decisions, spend some time skimming the news.

If you've kept up with your health and fitness resolutions thus far this year, you know that even minor adjustments in diet and exercise pay big dividends. The same goes for our individual and group decision-making approaches.

A bit of deliberate effort to strengthen the decision-process goes a long way towards minimizing or mitigating the impact of personal and group biases. Translation, this might just keep you out of those less than flattering headlines in the news.

At Least 5 Questions We Need to Ask Our Teams Before They Decide:

1. "How are we going to make this decision?"

2. "What data do we need to objectively evaluate our options?"

3. "Before we decide, how can we frame this issue in neutral terms?"

4. "What would someone who doesn't have history with this issue say about it?"

5. "If we were starting a business today, would we invest in this?"

While there are many and varying forms of decision-making traps and nearly countless combinations of cognitive biases that impact our discussion processes, the introduction of and follow-thru on these simple but important questions can clear much of the fog out of the way.

Improve Discussion Quality to Improve Decision-Making Effectiveness:

In working with under-performing management and project teams, one of the critical factors in improving results is in improving the quality of the discussions surrounding key decisions. Use the 5 questions above to strengthen processes and improve the quality of the dialogue and analysis.

Create a process to decide. The act of asking and then developing a process to decide is a powerful step in the right direction. This imposes both accountability and serves as a process guide to corral our all-too-frequent wide-ranging, overlapping and chaotic, emotion-packed dialogue around big issues. Another good practice for teams working on strengthening decision-making effectiveness, is for them to follow the "how should we" question with "What traps might impact our process here?" (See my related posts links below for more on this topic.)

Cut Through the Data Smog. Data is plentiful in today's organizations, yet we tend to anchor on data that supports our perspectives and dismiss data as flawed when it refutes our case. Challenge the team to think through data needs…and particularly to evaluate confusing correlation with causation…or to avoid sampling on the dependent variable. And of course, don't forget that in spite of massive advances in business intelligence and analytics software, the quality of the data should always be scrutinized before accepting it as gospel.

Frame for Fun and Profit. Positioning a situation as a gain or loss absolutely biases solution development. Spend time to carefully frame issues…and work to frame them as neutral if possible. Another approach is to invoke F. Scott Fitzgerald's maxim that, "the sign of a first rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function." Consider framing the issue in different ways and developing solution sets based on those frames.

"Tell me again about your assumptions." Always invite an outsider in for the big decisions. Someone who has no skin in the outcome can offer the candid perspective so often lacking in our politically turbocharged discussions. Instead of the tame or lame Devil's Advocate, invite someone in and listen carefully if they tell you that your baby is really ugly.

Let's Not Escalate this Commitment! Many of our issues resolve around past decisions and whether to carry on or not. Follow the above suggestions and ask and consider the very critical question of, "If we were starting a business today, would we invest in this?" If the answer is "no" put a stake in it. And remember, that the money you spent is a sunk cost…it's gone. Beware the "with more time and money" discussions.

The Bottom-Line for Now:

This is a big topic with big implications for your firm and for your career. However, the best way to eat an elephant is still one bite at a time.

Starting today, teach your teams to strengthen their decision-making processes by asking the annoyingly appropriate questions highlighted above. Remember, we want to keep you and your firm out of the headlines…at least when it comes to lousy decisions. And the last time I looked, most bosses bestow things like responsibility, money and authority on those who they trust to make good decisions.

Deciding whether to put effort forth to improve how to decide may be the only "no-brain" decision you'll encounter today.

Thanks to Art Petty / Art Pretty / Strategy & Management-Innovations, LLC.

http://artpetty.com/2012/02/06/leadership-caffeine-teach-your-team-smarter-decision-processes/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+artpetty%2Fmanagement_excellence+%28Management+Excellence+by+Art+Petty%29

| To Get Uninterrupted Daily Article(s) / Review(s) Updates; Kindly Subscribe To This BlogSpot:- http://Ziaullahkhan.BlogSpot.com Via "RSS Feed" Or "Email Subscription". | |

| BlogSpot | http://ziaullahkhan.blogspot.com |

| Other Sites Related To This Blog; Kindly Visit: | |

| Amazon Books | http://astore.amazon.com/amazon-book-books-20 |

| Amazon Magazines | http://astore.amazon.com/amazon-book-books-20?_encoding=UTF8&node=1323 |

| Kindle Store | http://astore.amazon.com/amazon-book-books-20?_encoding=UTF8&node=851 |

| Products | http://astore.amazon.com/amazon-everyday-low-prices-sale-deals-bargains-discounts-20 |

| Google+ | https://plus.google.com/i/TJK3yQ6lPWQ:hSGLwIJTQU8 |

| Facebook Page | http://www.facebook.com/pages/KnowledgeCenter-Products/267269689987751?sk=wall |

| http://twitter.com/#!/Babajan786 | |

| YouTube | http://www.youtube.com/user/ZKDQ786 |

How Much Are Unhealthy Workers Costing You, And What Can You Do About It?

Full-time workers in the United States who are overweight or obese and have other chronic health conditions miss about 450 million more days per year than healthy workers. According to a Gallup poll, this results in an annual productivity loss of $153 billion.

The Gallup-Healthways Well-Being Index finds that full-time workers of normal weight without chronic health conditions make up 13.9 percent of the U.S workforce and average about 4 days a year of absence. Workers of above normal weight with three or more chronic conditions average about 42 days of absence per year.

Another report, the "Thomson Reuters Workforce Wellness Index" finds that a decline in overall population health is contributing to rising healthcare costs and lost productivity for U.S. employers. The report cites an annual cost of unhealthy behavior of $623 per employee.

The index uses six behavioral risk factors to tract collective health of workers who have employer-sponsored health care. The risks are:

- Body mass index

- Blood pressure

- Cholesterol

- Blood glucose

- Tobacco use

- Alcohol use

In 2010, about 14 percent of direct healthcare costs for these employers was directed linked to the six factors. The single biggest factor was body mass index, which is used to measure obesity.

NIOSH Identifies Strategies

In a report entitled "Essential Elements of Effective Workplace Programs and Policies for Improving Worker Health and Wellbeing," NIOSH identifies four key areas employers need to address to improve worker health. We'll present two today, and two tomorrow.

1. Organizational Culture and Leadership

- Develop a "human centered culture." Effective programs thrive in organizations with policies and programs that promote respect throughout the organization and encourage active worker participation, input, and involvement.

- Demonstrate leadership. Commitment to worker health and safety, reflected in words and actions, is critical. The connection of workforce health and safety to the core products, services and values of the company should be acknowledged by leaders and communicated widely.

- Engage mid-level management. Supervisors and managers at all levels should be involved in promoting health-supportive programs. They are the direct links between the workers and upper management and will determine if the program succeeds or fails. Mid-level supervisors are the key to integrating, motivating and communicating with employees.

2. Program Design

- Establish clear principles. Effective programs have clear principles to focus priorities, guide program design, and direct resource allocation. Prevention of disease and injury supports worker health and well being.

- Integrate relevant systems. Program design involves an initial inventory and evaluation of existing programs and policies relevant to health and well-being and a determination of their potential connections. Programs should reflect a comprehensive view of health: behavioral health/mental health/physical health are all part of total health. Integration of diverse data systems can be particularly important and challenging.

- Eliminate recognized occupational hazards. Changes in the work environment (such as reduction in toxic exposures or improvement in work station design and flexibility) benefit all workers.

- Be consistent. Workers' willingness to engage in worksite health-directed programs may depend on perceptions of whether the work environment is truly health supportive. Individual interventions can be linked to specific work experience. For example, NIOSH says that industrial workers who smoke are more likely to quit and stay quit after a worksite tobacco cessation program if workplace dusts, fumes, and vapors are controlled and workplace smoking policies are in place.

- Promote employee participation. Ensure that employees are not just recipients of services but are engaged actively to identify relevant health and safety issues and contribute to program design and implementation. Barriers are often best overcome through involving the participants in coming up with solutions.

- Tailor programs to the specific workplace and the diverse needs of workers. Effective programs are responsive and attractive to a diverse workforce. One size does not fit all—flexibility is necessary.

- Consider incentives and rewards. Incentives and rewards, such as financial rewards, time off, and recognition, for individual program participation may encourage engagement, although poorly designed incentives may create a sense of "winners" and "losers" and have unintended adverse consequences.

- Find and use the right tools. Measure risk from the work environment and baseline health in order to track progress. For example, a Health Risk Appraisal instrument that assesses both individual and work-environment health risk factors can help establish baseline workforce health information, direct environmental and individual interventions, and measure progress over time.

- Adjust the program as needed. Programs must be evaluated to detect unanticipated effects and adjusted based on analysis of experience.

- Make sure the program lasts. Design programs with a long-term outlook to assure sustainability. Short-term approaches have short-term value. There should be sufficient flexibility to assure responsiveness to changing workforce and market conditions.

- Ensure confidentiality. Be sure that the program meets regulatory requirements (e.g., HIPAA, state laws, ADA) and that the communication to employees is clear on this issue. If workers believe their information is not kept confidential, the program is less likely to succeed.

3. Program Implementation and Resources

- Be willing to start small and scale up. Although an overall employee health improvement program design should be comprehensive, starting with modest targets is often beneficial if they are recognized as first steps in a broader program. For example, target reduction in injury rates or absence. Consider phased implementation of these elements if adoption at one time is not feasible. Use (and evaluate) pilot efforts before scaling up. Be willing to abandon pilot projects that fail.

- Provide adequate resources. Identify and engage appropriately trained and motivated staff. If you use vendors, make sure they are qualified. Take advantage of credible local and national resources from voluntary and government agencies. Allocate sufficient resources, including staff, space, and time, to achieve the results you seek. Direct and focus resources strategically, reflecting the principles embodied in program design and implementation.

- Communicate strategically. Effective communication is essential for success. Everyone (workers, their families, supervisors, etc.) with a stake in worker health should know what you are doing and why. The messages and means of delivery should be tailored and targeted to the group or individual and consistently reflect the values and direction of the programs. Communicate early and often, but also have a long-term communication strategy. Provide periodic updates to the organizational leadership and workforce. Maintain program visibility at the highest level of the organization through data-driven reports that allow for a linkage to program resource allocations.

- Build accountability into program implementation. Accountability reflects leadership commitment to improved programs and outcomes and should cascade through an organization starting at the highest levels of leadership. Reward success.

4. Program Evaluation

- Measure and analyze. Develop objectives and a selective menu of relevant measurements, recognizing that the total value of a program, particularly one designed to abate chronic diseases, may not be determinable in the short run. Integrate data systems across programs and among vendors. Integrated systems simplify the evaluation system and enable both tracking of results and continual program improvement.

- Learn from experience. Adjust or modify programs based on established milestones and on results you have measured and analyzed.

http://safetydailyadvisor.blr.com/archive/2012/02/01/safety_management_worker_health_improvement.aspx?Source=SDF&effort=18

| To Get Uninterrupted Daily Article(s) / Review(s) Updates; Kindly Subscribe To This BlogSpot:- http://Ziaullahkhan.BlogSpot.com Via "RSS Feed" Or "Email Subscription" Or "Knowledge-Center Yahoo Group". | |

| BlogSpot | |

| Other Sites Related To This Blog; Kindly Visit: | |

| Amazon Books | |

| Amazon Magazines | |

| Kindle Store | |

| Products | |

| Google+ | |

| Facebook Page | |