It's a darn good question, and one that continues to confound board compensation committees. How do they explicitly link short-term and long-term pay to company performance to ensure they're neither overpaying nor underpaying senior executives?

Certainly, not all companies are hitting the mark, despite trying their best. Some apparently are failing miserably, according to Robin Ferracone, author of the book, Fair Pay, Fair Play, and executive chair at compensation consultancy Farient Advisors. Ferracone has developed a system to analyze whether or not compensation and shareholder value are in alignment. When it comes to companies with pay for performance schemes that are out of whack, among them retail clothier Abercrombie & Fitch, she does not mince words. "Abercrombie employs a number of practices that work against alignment and cause the pay to be both unreasonable and insensitive to performance," Ferracone charges.

For example, she explains, Abercrombie has a 75th percentile pay positioning strategy, rather than a 50th percentile pay positioning strategy. A 75th percentile pay strategy means that Abercrombie has the intention of setting its pay at a point at which 25 percent of the market pays above that point and 75 percent of the market pays below that point—or intends to pay above the midpoint, or median, of the market. "The real pay positioning of the company's CEO (Mike Jeffries) is way above the 75th percentile, making the pay unreasonable," she notes. (Abercrombie & Fitch did not return phone calls seeking its input.)

65 percent of 260 corporate respondents introduced new financial performance measures in their annual incentive programs last year, or plan to introduce them this year.

The retail giant also provides what Ferracone says are "episodic mega-grants of options" to its CEO. "In 2008, they entered into a new employment agreement with [Jeffries, through 2014] and granted him four million options despite a low total shareholder return," she says. "They also provided retention bonuses in weak performance years. For instance, the company's CEO received a $6 million discretionary 'stay bonus' to stay through December 2008, which was a weak performance year."

One imagines that Abercrombie & Fitch's board had good reasons for keeping Jeffries at the top of the pyramid, and paying him is the only way to do that. Like all other organizations, it is on a quixotic journey to devise a compensation structure that incentivizes and rewards employees based on their respective merits, while trying at the same time to align this with shareholder value. This quest has guided many organizations to simply link incentive pay to the stock price—not the best strategy, many contend, since the stock market often rises and falls for reasons other than corporate performance.

On the bright side, some unique changes in compensation models are underway. To maximize shareholder value, more companies, for instance, are heavily weighting the use of performance shares and restricted stock in their compensation plans, and turning away from stock options. Others are paying above the median when they outperform peer groups of companies and, while that's not new, they're also beginning to reduce pay when they happen to underperform the competition. Some companies also are expanding the variety of financial and qualitative performance metrics to which both short-term and long-term compensation are linked.

Despite these improvements, a perfect pay for performance paradigm is the holy grail for many companies, which explains the constant tinkering with compensation structures. A 2011 survey by Mercer indicates that 65 percent of 260 corporate respondents introduced new financial performance measures in their annual incentive programs last year, or plan to introduce them this year. Half the respondents also say they plan to introduce new non-financial metrics in their incentive plans in 2011. As proxies roll out in the next weeks, we shall see what they have in mind.

Tinker Tailor

Incessant revisions of pay plans are not a new phenomenon. One hundred years ago pay was simple—all employees, including the president, were paid salaries. Then came a first: In 1929, the president of Bethlehem Steel received the first bonus ever paid—$1.6 million on top of his base $12,000 salary, reports Paul Hodgson, senior research associate at GovernanceMetrics International, a corporate governance research organization. "Bethlehem Steel did really well that year."

Hodgson marks some other historical milestones—the first stock option plan (Pfizer in 1952) and the first use of performance shares (CBS in 1971). Despite these "firsts," stock option strategies didn't really take off until the 1980s, and performance shares are only now seeing their heyday. "The intentions in all these cases were good," Hodgson says. "The theory was if the company does better, employees should make more money. Knowing this, they will then work smarter and harder to improve the company's performance."

So is pay for performance finally on track? Not really, says Hodgson. "Some CEOs can make a lot of money at not doing a very good job, simply because the stock market happens to be riding high," he notes. "The opposite also can hold true, with CEOs getting punished because the market has fallen—even though their companies' individual performance has improved."

Other pay watchers agree. "In general, there has been improvement in the pay for performance compensation system," says Mike Halloran, Mercer worldwide partner. "Is it perfect? No. Will it ever be perfect? No, if for no other reason than there are so many different views of what to measure over what time periods for tracking both performance and pay."

"It's a complicated question, whether companies are really paying for performance," says George Paulin, chairman and CEO of consultancy Frederic W. Cook & Co. "You can define and measure performance in a lot of different ways, and as many ways as you can do it that is how many ways it is being done. To me that shows that companies are at least trying."

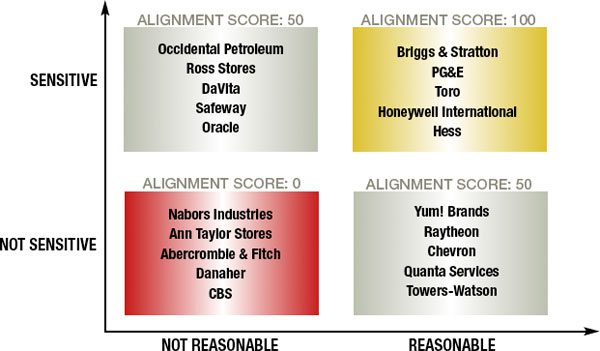

They may be trying but are they hitting pay dirt? Ferracone says only one-third of companies have developed pay for performance methodologies that are truly aligned with shareholder value. "Two-thirds have some improvements to do," she adds. "Their pay either is not reasonable for the size of their companies in the industry they're in from a shareholder return performance standpoint, or their pay is simply not sensitive to performance."

The author and consultant's aforementioned system for judging pay for performance is designed, she says, to encourage companies to make changes. "The key is for companies to look back each year historically to determine if the structure is really aligned with shareholder value and is truly rewarding people based on performance," Ferracone explains.

Halloran agrees that more ongoing assessment is needed. "Too many companies set good goals and standards, but then they don't run scenarios to determine if they're too much of a stretch," he says.

Consultancies do these exercises on a regular basis and continue to find misalignment. BDO recently examined the link between executive pay and company performance in 10 U.S. cities and found that the CEOs of companies with the best performance, expressed by total shareholder return, did not necessarily receive the highest pay increases. While the CEOs of companies with positive returns generally received pay increases, and those with negative returns saw pay decreases, there were notable exceptions in the margins.

These exceptions also tend to pop up in other consultancies' reports. "For the most part, CEOs receive the majority of their pay in equity, so when the stock price decreases their overall pay decreases," says Aaron Boyd, director of research at Equilar. "But, there are cases where CEOs walk away with a chunk of money that they, based on their companies' performance, didn't really deserve. It all comes down to the ways in which employees are rewarded in the short term for their individual contributions over the year, and over the long term for these contributions' impact on overall shareholder performance."

Scoring Alignment

"Reasonable" means the company's performance-adjusted total compensation is within a reasonable competitive range given the size, industry and Total Shareholder Return (TSR) of the company

** Sensitive means the company's performance-adjusted total compensation is sensitive to Total Shareholder Return (TSR) performance over time

Constructive Creativity

Within each of these areas, creative structures are being developed by compensation committees. This creativity is being driven, in part, by shareholder activism and new regulations. So-called say-on-pay provisions are the lay of the land at most organizations today. Golden parachutes are rapidly a thing of the past, and thanks to the Dodd-Frank financial reform bill signed last summer, companies may soon have to disclose the ratio of their CEOs' overall pay to the compensation of the rank and file. Let the comparisons begin!

Still, much of the tinkering can be chalked up to the rigor with which board compensation committees are seeking and crafting pay structures that align neatly with shareholder value. "We're seeing great strides being made in the metrics that companies are setting their performance bars around," says Halloran.

Deb Nielsen, who heads the compensation division at consultancy Kenexa, agrees. "The say-on-pay provisions got companies to make significant changes to their compensation plans," she says. "Now that the ways in which these plans are structured are more accessible to shareholders, it has compelled much greater attention to the individual components and whether or not they're truly driving performance."

The Long and Short Of It

Short-term incentive compensation plans, in the main, seem to be doing what they're intended to do, given that they're typically based on annual financial metrics like earnings per share, return on capital, revenue growth and other operating statistics. Boyd from Equilar says there are two distinct trends in short-term pay. "Some companies are moving away from cash toward granting equity as a bonus, while others want to give their executives money right now," he says. "Because of the economy, both types of bonuses dropped somewhat dramatically in recent years and are only now beginning to tick up."

Hodgson warns that they may be ticking up too much. "Bonuses are much more sensitive to performance than most other incentive-based types of pay, although that can be undermined by boards paying out discretionary bonuses because the company failed to hit its targets," he explains. "Boards justify the bonuses by saying, 'It wasn't the fault of the executives.' The popularity of discretionary bonuses, especially in hard economic times like the last two years, would suggest that some boards are abusing this privilege."

"The popularity of discretionary bonuses, especially in

hard economic times like the last two years, would suggest that some boards are abusing this privilege."

Halloran would like to see more use of non-financial metrics to judge and justify bonuses. "EPS is great, but what about metrics like customer service, environmental sustainability, safety or even market share, which are just as critical to the success of the business?" he asks. "Managing a company successfully is more than about the numbers."

At Lincoln Financial Group, both quantitative and non-financial metrics are compensation plan triggers. "To us, pay for performance has two pieces—one based on specific metrics like sales growth, EPS or budget controls, and the other based on individual achievements that are more qualitative," says Dennis R. Glass, CEO of the Philadelphia-based financial services organization. "We adapt or customize our plan based on the true performance indicators in regard to the person's position. For instance, if you're in IT working on a platform transformation, where the contractor and consultant spend is critical, we may heavily weight 'controllable budget expenses' as a factor in the short-term incentive plan."

Lincoln Financial also cleaves its pay structure based on the hierarchy of an executive in the organization. "My long-term incentive pay, for example, is around 65 percent of my total compensation, whereas for a lower-level manager it might be 20 percent, and for people who report directly to me in the 40 percent to 50 percent range," Glass explains.

Long-term compensation is where the biggest changes in pay for performance plans has occurred. "Companies are seeking ways to address the 'all ships rise and fall with the market' compensation disconnect," says Hodgson. "Stock price is not a particularly sensitive performance indicator for measuring performance—it's just too blunt an instrument. Consequently, we're seeing more interest in the use of index-linked stock options, where the exercise price rises or falls either with the S&P 500 or an individual industry sector. To make money you essentially have to outperform your peer group, which is a fairer means of accounting for performance."

While there is greater interest in this model, he acknowledges that only a few companies have adopted it at this point. "So we're left with performance shares as the second best savior," Hodgson says.

The way performance shares work is that the executive has an opportunity to earn a certain number of shares based on pre-defined performance goals. The better the performance of the company, the more shares the person can earn, typically up to a defined cap. The value of the award is the number of shares earned multiplied by the stock price, over the customary performance period of three years. Conversely, the worse the performance, the fewer shares the person earns. Indeed, the number of shares earned can go to zero.

For performance shares to truly be aligned to shareholder interests, Ferracone says the criteria by which performance is measured need to be right. "The trick, from an investor standpoint, is for the company to get the measures and the goals right; otherwise, the executive may be earning shares when the shareholders are faring poorly," she says.

"The use of performance shares has been a big plus to long-term incentive plans."

What can go wrong with these measures and goals? To illustrate, Ferracone cites the case of a recent client that was measuring relative total shareholder value, "suggesting that its executives would earn shares only if the shareholders were doing well," she says. "It turns out that the peer group's stock price was a lot less volatile than the client's stock price, and so, the client company was being rewarded just for volatility in the good times."

Performance shares don't necessarily require a company to outperform its peers, but they do require that it hit quantitative financial targets like EPS and total stockholder return before shares can vest. "The use of performance shares has been a big plus to long-term incentive plans," says Halloran. "They combine financial long-term goals set by the company, in addition to more traditional financial performance targets like stock price. Our research indicates that half of all companies now utilize performance shares in their plans."

Pay Policy Changes on the Rise

Source: "Executive Performance and Pay Alignment Score," Farient Advisors.

As companies adopt performance shares as an incentive pay model, they're conversely reducing the use of traditional stock options. "Stock options used to be the lion's share of long-term compensation packages—no longer because their perceived value is less than their cost," says Peter Chingos, senior partner at consultancy Compensation Advisory Partners. "Today it is a more level playing field among different long-term incentive choices. Many companies have moved towards long-term performance shares since the financial performance measures are viewed as more under the control of management, and the cost of the plan is more closely aligned with actual incentive payouts and shareholder interests."

Kenexa's Nielsen also notes the shift away from stock options. "They cost the organization insofar as share dilution, not to mention there is conceivably no value to the executive," she explains. "If the option doesn't pay off, how does that enhance the company's retention of that executive? Performance shares give you the opportunity to not dilute your stock and are more oriented to performance."

The use of restricted stock—stock that can't be exercised, say, for five years—also is growing in use, given their greater value to employee retention aims. Both restricted stock and traditional stock options have vesting periods. The difference is that when a stock option vests, the executive has the option of purchasing or not purchasing the stock at the strike price. He or she doesn't own the stock until the option is exercised and the stock is purchased. At that point, the executive can sell or keep the stock.

When a restricted stock award vests, the executive owns the stock and can do whatever he or she wants with it. "The downside to both stock awards is that there are no performance conditions attached—the stock still resides in a market that rises and falls based on factors beyond just company performance," Hodgson explains.

There goes that perfect paradigm again. But, Chingos offers a long-term incentive pay alternative that combines the best of each compensation practice. It's akin to a portfolio approach that breaks pay down into 50 percent performance shares, 25 percent stock options and 25 percent restricted stock. "It's the new paradigm, and without question the future," he asserts. "The days of 100 percent stock options are over."

Plans that pay more to executives when the company outperforms its peers but don't pay less when the company underperforms its counterparts are also out of fashion. "More companies realize that the plan has to be structured to go both ways—pay for performance and less-pay for less-performance," Chingos says.

Glass says Lincoln Financial is in the midst of altering its long-term incentive pay targets, reducing the reliance on stock options and increasing the use of restricted stock and performance shares based on EPS, return on equity and top-line revenue growth. The firm also has restructured its short-term pay for performance model in a way that is similar to Chingos' "both ways" advice.

"We call it the 'individual modifier,'" Glass says. "Everyone here has the opportunity to increase or decrease someone else's incentive pay based on their individual performance. So if someone only gets 80 percent of their bonus because they didn't fully hit their performance targets, that's 20 percent to be awarded to someone else."

Or, in other words, "Pay up."

Key Takeaways

- Moves are afoot by many board compensation committees to alter their pay for performance compensation models.

- In the future, more performance shares and restricted stock will comprise more of CEO pay.

- The perfect incentive pay structure remains elusive.

No comments:

Post a Comment