After dipping briefly in March, Chief Executive's CEO Confidence Index is back on the rise. The index, which assesses the state of the U.S. economy through the eyes of its CEOs, rose 3.3% to a solid 6.22 in April. March's 6.02 index, while still considered 'good', was heavily influenced by Japan's earthquake and the increasing turmoil in the Middle East. As geopolitical issues calmed in April, so did the CEO outlook.

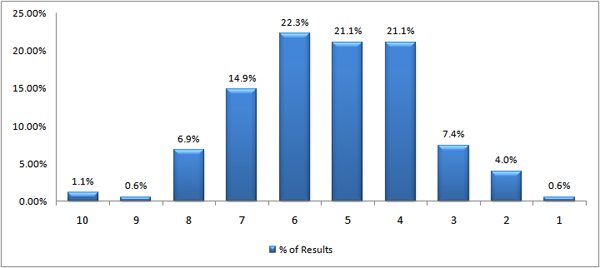

April saw an overall increase in CEO forecasts, with 68.1% of chief executives foreseeing a 'good' or better economic future; this number is up from 66% in March, but is still lower than February's 70% 2011 high. Though the outlook over the next twelve months is bright, most CEOs still aren't as pleased with current overall business conditions. CEOs' assessment of current conditions was only 5.30, though up over 3% from March.

CEOs' outlooks also varied by size of the company. There is an almost one point difference between the score for companies with revenues below $25 million and those with revenues above $25 million. Businesses that brought in under $25 million a year rated the economic outlook as 5.69 whereas companies that brought in more than $25 million a year saw a much brighter future. These larger companies had an economic outlook of 6.65. In fact 56.4% of companies with revenues between $100 million and $1 billion dollars ranked the future of the economy as a 7 or 8 (the average total score for these large companies was 6.78) and companies with revenues over $1 billion also were more optimistic about the next 12 months.

As one CEO said, "Business conditions overall are beginning to ripen. Some business sectors are bouncing back quicker than others. Some locations are responding better than others depending on the region, primary business functions in those regions and how quickly they can adapt to constantly changing environments."

CEO employment plans support the overall higher Index score. In March, only 41% of respondents expected to hire new employees and 47% expected to have no change in their number of employees. In April, however, 49% of CEOs expected to hire new employees and only 33.7% expected to see no change. Most hires will be in numbers less than 10% of the current workforce size, but this is a significant improvement from March's plurality who anticipated a hiring freeze over the next year.

There has also been a jump in capital expenditure projections. Fifty-six percent of CEOs are expecting to increase capital expenditures over the next 12 months, compared to only 51.5% expecting to do so in the March survey.

Many CEOs focus on future government recovery and regulatory efforts when assessing the future. One CEO says, "We have not stabilized yet. First, it was our commercial business, and now it is our government business." Another CEO agrees, "The economy's recovery is proportionate to the amount of government involvement. The more government, the slower the recovery."

CEO Confidence Index – April 2011

| Respondents: 175 | March 2011 | April 2011 | Monthly Change |

| CEO Confidence Index | 6.02 | 6.22 | - 3.3% |

What do expect overall business conditions to be like one year from now on a 1 -10 scale? (10 = Excellent)

What is your assessment of current overall business conditions on a 1-10 scale? (10 = Excellent)

Over the next 12 months, what changes do you forecast for your firm compared to the past 12 months?

Thanks to Chief Executive Group, LLC

http://chiefexecutive.net/confidence-on-the-rise-for-big-companies-while-small-ones-are-still-weary

No comments:

Post a Comment