The South Sea Company (1711 – c1850s) was an English company granted a monopoly to trade with South America under a treaty with Spain. Following the South Sea Company Act of 1720, it became better known for the "South Sea Bubble", an economic bubble that occurred through overheated speculation in the company shares. The stock price collapsed after reaching a peak in September 1720.

Initial stages

The company, established in 1711 by the Lord Treasurer, Robert Harley, was granted exclusive trading rights in Spanish South America. (The British at that time applied the term "South Seas" to South America and surrounding waters, not to the South Pacific, an area that was still mostly unknown to Europeans.) The trading rights were pre-supposed on the successful conclusion of the War of the Spanish Succession, which did not end until 1713, and the actual granted treaty rights were not as comprehensive as Harley had originally hoped.

Harley needed to provide a mechanism for funding government debt incurred in the course of that war. However, he could not establish a bank, because the charter of the Bank of England made it the only joint stock bank. He therefore established what, on its face, was a trading company, though its main activity was in fact the funding of government debt.

In return for its exclusive trading rights the government saw an opportunity for a profitable trade-off. The government and the company convinced the holders of around £10 million of short-term government debt to exchange it with a new issue of stock in the company. In exchange, the government granted the company a perpetual annuity from the government paying £576,534 annually on the company's books, or a perpetual loan of £10 million paying 6%. This guaranteed the new equity owners a steady stream of earnings to this new venture. The government thought it was in a win-win situation because it would fund the interest payment by placing a tariff on the goods brought from South America

The Treaty of Utrecht of 1713 granted the company the right to send one trading ship per year (though this was in practice accompanied by two 'tenders') and the 'Asiento', the contract to supply the Spanish colonies with slaves.

The company did not undertake a trading voyage to South America until 1717 and made little actual profit. Furthermore, when ties between Spain and Britain deteriorated in 1718 the short-term prospects of the company were very poor. Nonetheless, the company continued to argue that its longer-term future would be extremely profitable.

Debt for equity

In 1717 the company took on a further £2 million of public debt. The rationale in all these transactions was to the

- Government: lower interest rate on its debt

- South Sea Company (owners): a steady stream of earnings

- Government Debt Holder: upside potential in a promising enterprise

Slave trading

Most commentary on the South Sea Company focuses on the money lost by English investors. The primary trading business of the company was the forced transportation of people purchased in West Africa and then selling them into slavery in the Americas. In fact, the most important aspect of the company's monopoly trading rights to the Spanish empire was the 1713 Treaty of Utrecht's slave trading 'Asiento' which granted the exclusive right to sell slaves in all of American colonies.

The Asiento set a quota of selling 4800 people into slavery a year. Despite its problems with speculation, the South Sea Company was relatively successful at selling people into slavery and meeting its quota (it was unusual for other, similarly chartered companies to fulfill their quotas). According to records compiled by David Eltis et al, during the course of 96 voyages in twenty-five years, the South Sea Company purchased 34,000 slaves of whom 30,000 survived the voyages across the Atlantic.

The mortality rate of about 15% was not unusual for ships participating in the middle passage and indicates that the organization was a relatively efficient slave trader. Employees, directors and investors overcame major obstacles in order to pursue the slave trade, including two wars with Spain and the 1720 bubble. The company sold its largest number of slaves during the 1725 trading year, five years after the bubble burst.

Trading more debt for equity

In 1719 the company proposed a scheme by which it would buy more than half the national debt of Britain (£30,981,712), again with new shares, and a promise to the government that the debt would be converted to a lower interest rate, 5% until 1727 and 4% per year thereafter.

The purpose of this conversion was similar to the old one: it would allow a conversion of high interest, but difficult to trade debt, into low interest, readily marketable debt/shares of the South Sea Company. All parties could gain.

For a clarification of the situation the total government debt in 1719 was £50 million:

- £18.3m was held by three large corporations:

- £3.4m by the Bank of England.

- £3.2m by the British East India Company.

- £11.7m by the South Sea Company.

- Privately held redeemable debt amounted to £16.5m.

- £15m consisted of irredeemable annuities, long fixed-term annuities of 72-87 years and short annuities of 22 years remaining maturity.

The Bank of England proposed a similar competing offer, which did not prevail when the South Sea raised its bid to £7.5m (plus approximately £1.3m in bribes). The proposal was accepted in a slightly altered form in April 1720. The Chancellor of the Exchequer, John Aislabie, was a strong supporter of the scheme.

Crucial in this conversion was the proportion of holders of irredeemable annuities that could be tempted to convert their securities at a high price for the new shares. (Holders of redeemable debt had effectively no other choice but to subscribe.) The South Sea Company could set the conversion price but could obviously not diverge a lot from the market price of its shares.

The company ultimately acquired 85% of the redeemables and 80% of the irredeemables.

Buoying the share price

The company then set to talking up its stock with "the most extravagant rumours" of the value of its potential trade in the New World which was followed by a wave of "speculating frenzy". The share price had risen from the time the scheme was proposed: from £128 in January 1720, to £175 in February, £330 in March and, following the scheme's acceptance, to £550 at the end of May.

What may have supported the company's high multiples (its P/E ratio) was a fund of credit (known to the market) of £70 million available for commercial expansion which had been made available through substantial support, apparently, by Parliament and the King.

Shares in the company were "sold" to politicians at the current market price; however, rather than paying for the shares, these lucky recipients simply held on to what shares they had been offered, "sold" them back to the company when and as they chose, and received as 'profit' the increase in market price. This method, while winning over the heads of government, the King's mistress, etc., also had the advantage of binding their interests to the interests of the Company: in order to secure their own profits, they had to help drive up the stock. Meanwhile, by publicizing the names of their elite stockholders, the Company managed to clothe itself in an aura of legitimacy, which attracted and kept other buyers.

Bubble Act

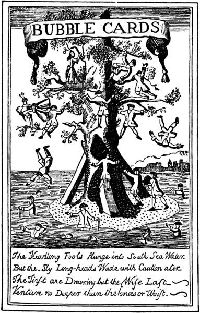

A number of other joint-stock companies then joined the market, making usually fraudulent claims about other foreign ventures or bizarre schemes, and were nicknamed "bubbles".

In June, 1720, the Royal Exchange and London Assurance Corporation Act 1719 (repealed in 1825) required all joint-stock companies to have a Royal Charter. This became known as the "Bubble Act" later, after the speculative bubble had burst. The real purpose of the Act was to prevent other companies competing for capital against the South Sea Company. The South Seas Company held a charter providing exclusive access to all of Middle and South America. However, the areas in question were Spanish colonies, and Great Britain was then at war with Spain. Even once a peace treaty had been signed, relations between the two countries were not good. The best terms that the South Sea Company was able to obtain allowed them to send only one ship per year to Spain's American colonies (not one ship per colony; exactly one ship), carrying a cargo of not more than 500 tons. Additional wrangling won the company the right to transport slaves, although steep import duties made the slave trade entirely unprofitable.

The grant of a charter to the South Sea Company was an added boost, its shares leaping to £890 in early June. This peak encouraged people to start to sell; to counterbalance this the company's directors ordered their agents to buy, which succeeded in propping the price up at around £750.

Top reached

The price of the stock went up over the course of a single year from one hundred pounds a share to over one thousand pounds per share. Its success caused a country-wide frenzy as citizens of all stripes – from peasants to lords – developed a feverish interest in investing; in South Seas primarily, but in stocks generally. Among the many companies, more or less legitimate, to go public in 1720 is – famously – one that advertised itself as "a company for carrying out an undertaking of great advantage, but nobody to know what it is".[1]

The price finally reached £1,000 in early August and the level of selling was such that the price started to fall, dropping back to one hundred pounds per share before the year was out, triggering bankruptcies amongst those who had bought on credit, and increasing selling, even short selling - selling borrowed shares in the hope of buying them back at a profit if the price falls.

Also, in August 1720 the first of the installment payments of the first and second money subscriptions on new issues of South Sea stock were due. Earlier in the year Blunt had come up with an idea to prop up the share price — the company would lend people money to buy its shares. As a result, a lot of shareholders could not pay for their shares other than by selling them.

Furthermore, the scramble for liquidity appeared internationally as "bubbles" were also ending in Amsterdam and Paris. The collapse coincided with the fall of the Mississippi Scheme of John Law in France. As a result, the price of South Sea shares began to decline.

By the end of September the stock had fallen to £150. The company failures now extended to banks and goldsmiths as they could not collect loans made on the stock, and thousands of individuals were ruined (including many members of the aristocracy). With investors outraged, Parliament was recalled in December and an investigation began. Reporting in 1721, it revealed widespread fraud amongst the company directors. The newly appointed First Lord of the Treasury Robert Walpole, who had argued against the scheme from the beginning, was forced to introduce a series of measures to restore public confidence.

Restructuring

The company continued its trade (when not interrupted by war) until the end of the Seven Years' War. However, its main function was always managing government debt, rather than trading with the Spanish colonies. The South Sea Company continued its management of the part of the National Debt until it was abolished in the 1850s.

Quotes on the bubble

Joseph Spence wrote that Lord Radnor reported to him "When Sir Isaac Newton was asked about the continuance of the rising of South Sea stock? ---- He answered 'that he could not calculate the madness of people'. (Spence, Anecdotes, 1820, p368); Newton's niece Catherine Conduitt reported that he had participated and "lost twenty thousand pounds. Of this, however, he never much liked to hear..." (Wm Seward, Anecdotes of distinguished Men, 1804); this was a fortune at the time but it is not clear whether it was a monetary loss or an 'opportunity-cost' loss.

This article is copied from an article on Wikipedia® - the free encyclopedia created and edited by online user community. The text was not checked or edited by anyone on our staff. Although the vast majority of the Wikipedia® encyclopedia articles provide accurate and timely information please do not assume the accuracy of any particular article. This article is distributed under the terms of GNU Free Documentation License.

Thanks to Encyclopedia The Free Dictionary / Farlex, Inc.

http://encyclopedia.thefreedictionary.com/p/South%20Sea%20Bubble

| To Get Uninterrupted Daily Article(s) / Review(s) Updates; Kindly Subscribe To This BlogSpot:- http://ZiaullahKhan.Blogspot.com/ Via "RSS Feed" Or " Email Subscription" Or "Knowledge Center Yahoo Group". | ||

| Amazon Magazine Subscriptions | Amazon Books | Amazon Kindle Store |

| Amazon Everyday Low Prices, Sales, Deals, Bargains, Discounts, Best-Sellers, Gifts, Household Consumer Products | ||

No comments:

Post a Comment